December 31st is the best day of the year to buy INVU and all penny shares. This is especially true when a stock market closes the year near its high. The reasons why:

- Penny stocks are inherently more volatile than blue chip stocks. Thus, the probability is high for an investor to have a paper loss for the penny stock which they purchased earlier in the year. There are also blue-chip loser stocks which decline to below double-digit prices during the year.

- The buyers of penny stocks invest the majority of their cash in blue-chip stocks. Thus, the probability is high for investors to have accrued short term capital gains from trading blue chips throughout the given year.

To reduce their April 15th of the next year tax liability investors with short term gains sell everything in which they have a short-term loss by the end of the year. Shares are sold at whatever the market price is to lock in a capital loss which can be used to offset a year’s capital gains. The indiscriminate selling creates opportunities for savvy year-end investors to reap significant short-term gains.

A good example is RYU Apparel which was recommended by ShinyPennySTocks.com on 12/30/2021. The chart at the bottom of the page depicts that RYU was a candidate for indiscriminate tax loss selling in 2019 and 2020. In December 2019, the share price reached a low of $0.17. At its high for January 2020, the share price reached $0.28, an increase of 65%. The same thing happened in December of 2020 when the share price traded at the $0.0935 low for the month. At the January 2021 high of $0.13, the share price had increased by 39%.

The table below contains ShinyPennyStocks.com’s existing recommendations. The table depicts that the share prices for five of the seven reached their post high lows in December of 2021.

The shares of all of the companies in the above table as of 12/29/21 had declined by a minimum of 68.9% from their highs. All are well below ShinyPennyStocks.com price limits and should be purchased via an at market order and by December 31, 2021, market close. Each have the rationale to support a double or a triple digit percentage increase for their share prices in 2022. For why the companies were recommended subscribe to a free 60-day trial to ShinyPennyStocks.com.

The company with the most intense tax loss selling pressure due to a 93% decline from the 2021 high is Investview. It’s unequivocally the most undervalued of all of ShinyPennyStocks.com recommendations. The chart below depicts the share price going from ShinyPennyStocks.com’s initial 3¢ limit price in 2019 to a high of 79¢ in April of 2021.

The intense pressure on the share price is being caused by those investors who purchased a cumulative 198.6 million shares for 39¢ and above through April 2021. They have been pounded the share price throughout December 2021 to take their losses to offset their taxable blue-chip gains throughout 2021.

Investview has to rank as the most undervalued of all public companies that I have come across throughout my 44 years in the market. My claim is based on the research that I have conducted on the company’s most recent financial reports which disclosed the following statistics for its latest 12 months:

- $120 million of annualized revenue growing at 247% per annum

- $40.8 million of annualized operating income growing at 426% per annum

- $27.6 million of annualized FREE CASH FLOW versus a negative $2.1 million

Investview’s valuation metrics based on its 12/29/21 market cap of $173 million:

- Free Cash Yield: 16%

- Price to Sales multiple: 1.4

- Price to Earnings multiple: 3

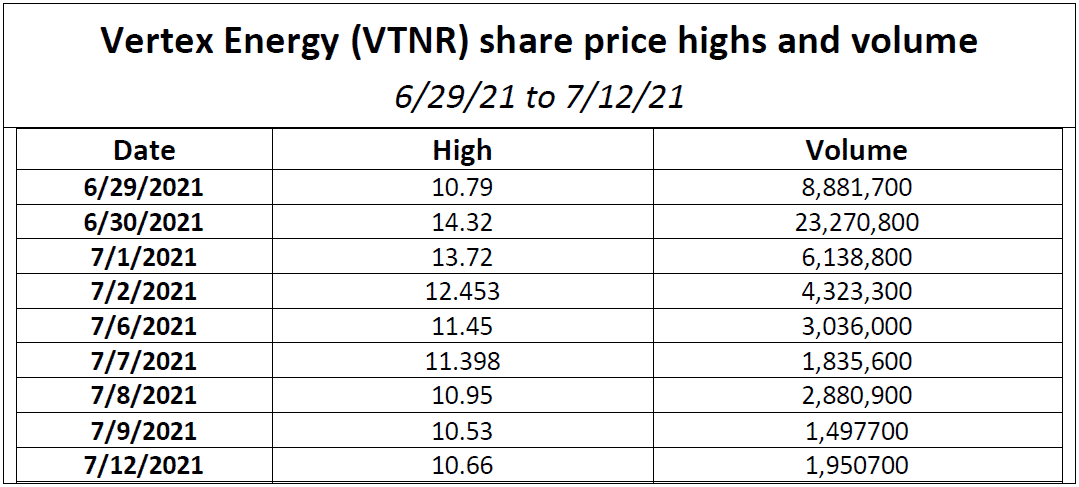

Not surprisingly, the chart below is for Vertex Energy (VTNR) which has also been under intense selling pressure due to its share price declining by 68% from the June high. Vertex Energy which was initially recommended by ShinyPennyStocks.com (SPS) on April 1, 2021 @ $1.49 per share via SPS’ AVGI buy limit strategy.

The 53.8 million shares which were subsequently purchased for above $10.00 have resulted in Vertex’s share price also being under intense tax loss selling pressure during December 2021.

The chart below depicts that ShinyPennyStocks.com via its AVGI strategy amended VTNR’s buy limit prices for Vertex on 11/16/21 and also on 12/27/21. For rationale on raise of limit price for second 50% stake being higher ($5.00) than the first 50% ($4.30) see VTNR/AVGI strategy.