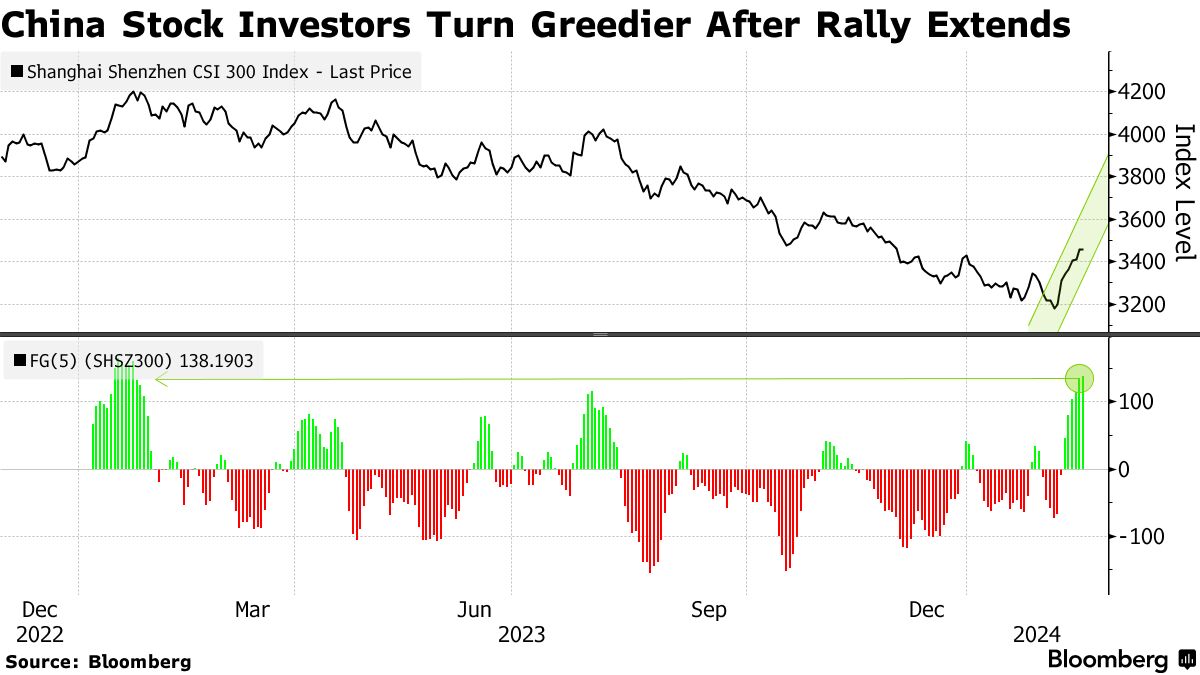

Investors in Chinese equities are becoming increasingly greedy as efforts by policy makers to stabilize the stock market gave a boost to confidence.

The so-called Fear and Greed indicator, a measure of buying strength versus selling strength, for the CSI 300 Index rose to its highest level since last January, suggesting the gauge may enter a period of strength. The benchmark has gained almost 1% so far this year, after posting an unprecedented third year of losses in 2023.

Sentiment has been buoyed by a slew of supportive measures, including a ban on reducing equity holdings at the open and close of each trading day and tighter supervision of quantitative trading.

Written by: Bloomberg News — With assistance from John Liu and Lin Zhu @Bloomberg

The post “Greed Returns to China’s Stock Market as Policy Buoys Confidence” first appeared on Bloomberg

BullsNBears.com was founded to educate investors about the eight secular bear markets which have occurred in the US since 1802. The site publishes bear market investing recommendations, strategies and articles by its analysts and unaffiliated third-party and qualified expert contributors.

No Solicitation or Investment Advice: The material contained in this article or report is for informational purposes only and is not a solicitation for any action to be taken based upon such material. The material is not to be construed as an offer or a recommendation to buy or sell a security nor is it to be construed as investment advice. Additionally, the material accessible through this article or report does not constitute a representation that the investments or the investable markets described herein are suitable or appropriate for any person or entity.