- Taiwan, Japan, South Korea PMIs remain just below 50-threshold

- Business optimism improves as demand seen to rebound this year

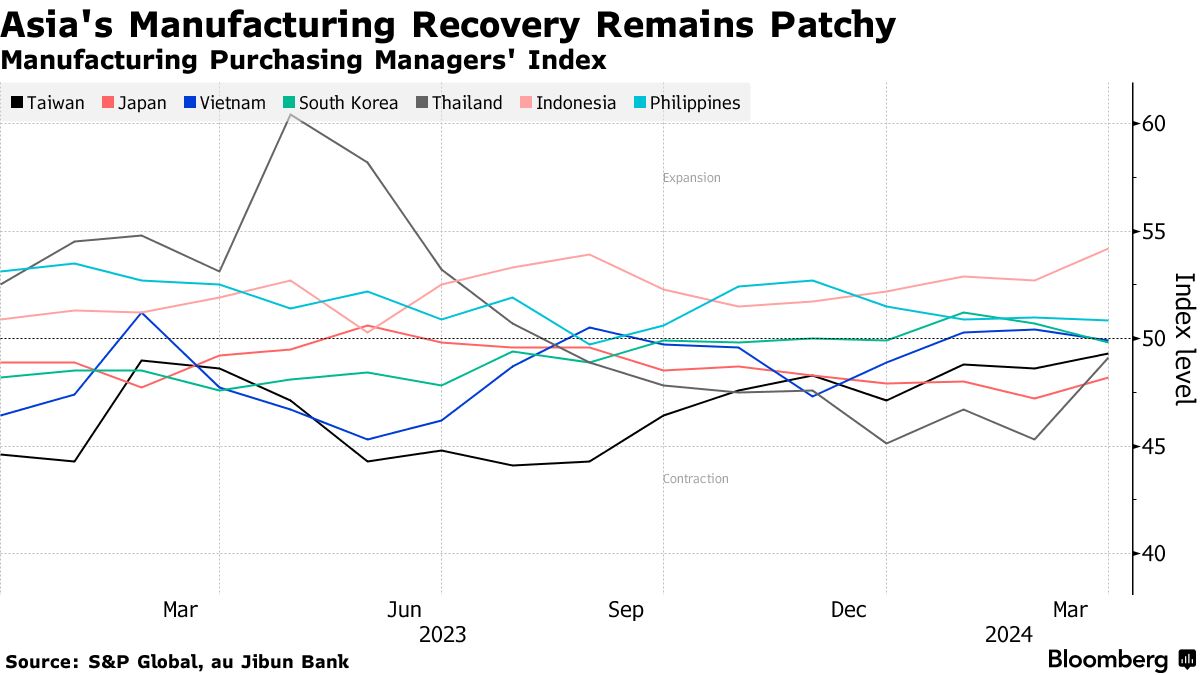

Asia’s manufacturing activity painted a mixed picture in March as new orders and output worsened for some amid still subdued global demand conditions, while others indicated a recovery as China extends industrial rebound.

Purchasing managers indexes for South Korea and Vietnam, the region’s manufacturing hubs, slipped back into contraction zone during the month, even as readings for trade bellwether Taiwan and Japan showed an improvement, surveys published by S&P Global and au Jibun Bank showed Monday.

South Korea’s index fell to 49.8 from 50.7 in February, the lowest reading since October 2023, while Japan saw its PMI jump to 48.2 from 47.2 amid signs that the worst of the weakness had passed. Taiwan’s PMI surged to 49.3 from 48.6, while still remaining below the 50 mark that separates expansion and contraction.

Despite lower orders for key export markets like China, the US and Europe in March, Taiwan’s factories reported their highest confidence in nearly three years on bets that sales and productivity will pick up in the months ahead. “Signs of price and supply stability are helping support a more optimistic outlook,” said S&P Global Market Intelligence Director Paul Smith.

Manufacturing in Asia has seen a stop-start recovery so far this year as supply chain disruptions and rising prices dampen the gradual pick-up in goods demand. Still, business sentiment is on the up amid signs that global trade — and the Chinese economy — is on the mend.

China’s Caixin manufacturing PMI rose to 51.1 on Monday, its fifth straight month in expansion mode to post its longest streak in more than two years. A day prior, an official gauge of factory activity snapped a five-month contraction, suggesting that the world’s second-largest economy is finally gaining momentum.

Most factories across Asia reduced output and new orders last month at softer rates, according to the PMI surveys. In a sign of growing confidence, manufacturers in some geographies even raised their staffing and purchasing activity to prepare for a ramp-up in production.

“Firms were optimistic that this period would pass over the coming year and a broad-based economic and demand recovery would help to stimulate orders and new product launches,” S&P economist Usamah Bhatti said of Japan’s factory conditions.

Thailand likewise saw a big jump in its PMI to 49.1 from 45.3, while Myanmar climbed to 48.3. Indonesia and the Philippines led Asia’s manufacturing expansion, with PMI readings at 54.2 and 50.9, respectively.

Written by: Claire Jiao @Bloomberg

The post “Asia’s Factories See Uneven Recovery as China Enjoys Upswing” first appeared on Bloomberg

BullsNBears.com was founded to educate investors about the eight secular bear markets which have occurred in the US since 1802. The site publishes bear market investing recommendations, strategies and articles by its analysts and unaffiliated third-party and qualified expert contributors.

No Solicitation or Investment Advice: The material contained in this article or report is for informational purposes only and is not a solicitation for any action to be taken based upon such material. The material is not to be construed as an offer or a recommendation to buy or sell a security nor is it to be construed as investment advice. Additionally, the material accessible through this article or report does not constitute a representation that the investments or the investable markets described herein are suitable or appropriate for any person or entity.