- Central bank expected to start easing cycle after pace slows

- Prices ease after everyday food items double in three years

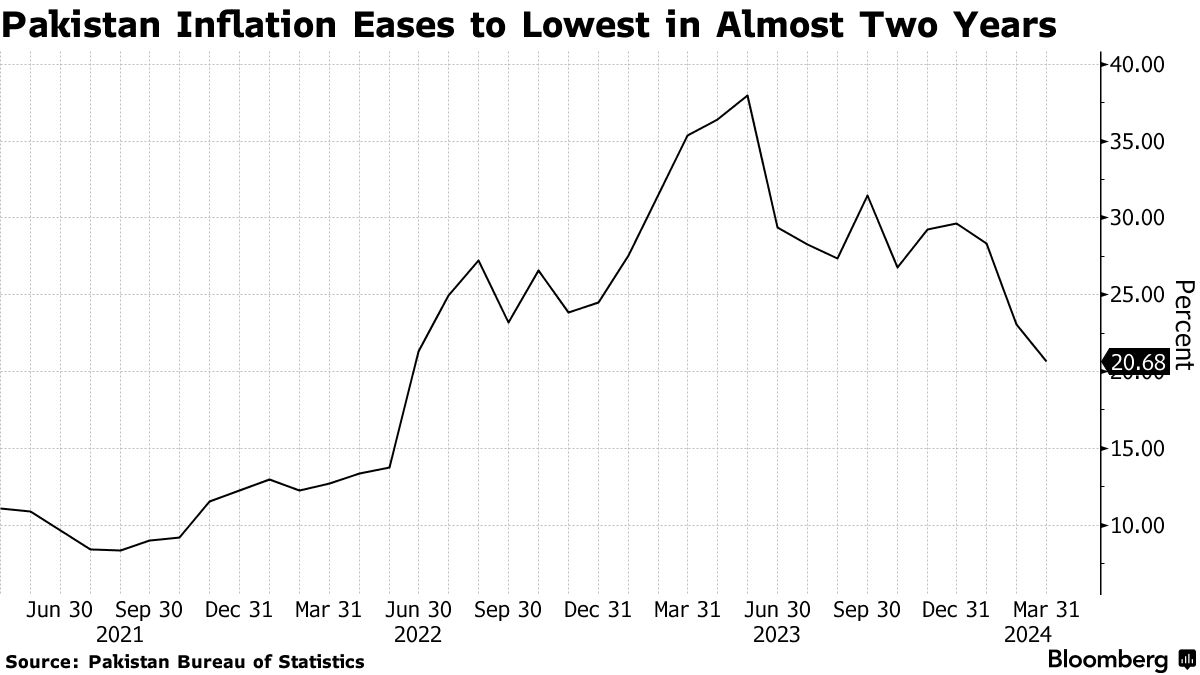

Pakistan’s inflation pace eased in March for a third month in a row to the lowest in almost two years as record borrowing costs weakened economic growth and domestic demand.

Consumer prices rose 20.68% from a year ago, according to data released by the Pakistan Bureau of Statistics on Monday. That compares with a median estimate for a 20.4% gain in a Bloomberg survey and 23.06% in February.

The slowing momentum is due in part to the base effect of surging inflation last year. It backs the State Bank of Pakistan’s decision to keep the benchmark interest rate at a record for a sixth straight meeting earlier in March on concerns price gains could run up again.

Analysts and Pakistan’s Finance Minister Muhammad Aurangzeb expect the central bank will cut borrowing costs as price gains continue to ease. The next policy review is set for April 29.

The March reading brings some relief to Prime Minister Shehbaz Sharif, who returned to power after contentious elections in February, as he looks to stabilize the fragile economy with the help of the International Monetary Fund. Pakistan’s economic growth weakened in the fiscal second quarter as gross domestic product expanded 1% after industrial sector contracted.

Pakistan is still home to the fastest inflation in Asia where prices for everyday items such as rice, wheat and sugar have doubled in the past three years. Almost half of the Pakistanis surveyed in a Gallup poll earlier this year are finding it hard to get by on their present income.

The latest data from the statistics bureau showed food costs rose 17.22% in March from a year ago period compared with 2.91% last month. Transport prices climbed 11.16%, while housing costs increased by 36.60%.

Written by: Kamran Haider @Bloomberg

The post “Pakistan Inflation Eases to Two-Year Low After Demand Slump” first appeared on Bloomberg

BullsNBears.com was founded to educate investors about the eight secular bear markets which have occurred in the US since 1802. The site publishes bear market investing recommendations, strategies and articles by its analysts and unaffiliated third-party and qualified expert contributors.

No Solicitation or Investment Advice: The material contained in this article or report is for informational purposes only and is not a solicitation for any action to be taken based upon such material. The material is not to be construed as an offer or a recommendation to buy or sell a security nor is it to be construed as investment advice. Additionally, the material accessible through this article or report does not constitute a representation that the investments or the investable markets described herein are suitable or appropriate for any person or entity.