I knew this letter’s topic months ago. It was going to be a review of the Strategic Investment Conference, which would have just concluded fabulously in sunny Scottsdale.

Well, something intervened. Coronavirus precautions kept us from having an in-person conference. No one was more disappointed than me. I often say SIC is the highlight of my year, and I’m not kidding. Being around so many brilliant minds, soaking up their knowledge, and all the while meeting and talking with so many loyal readers and close friends—it’s just an amazing experience.

Yet I have to say, the Virtual SIC we are now halfway through is amazing, too. It’s different, obviously. Instead of shaking hands, I’m sitting in front of a camera in my makeshift bedroom studio. There’s no applause or hallway chats or wonderful meals with friends. But we’ve made up for the missing elements with extra speakers and a stretched-out schedule. It’s a little less intense—and a lot more relaxed.

We have two days to go and you can still join us. More on that below. But first, I want to share some first-week highlights.

Week 1 Highlights

When people fly in from all corners of the world, as normally happens, we pack SIC into three-and-a-half days in order to respect everyone’s time. This year the whole concept of “time” is different, so we adapted a bit. The program is five days in total but we’ve split them up, and the days are shorter. This week it’s Monday-Wednesday-Friday, and next week Tuesday-Thursday.

I’m writing this letter on Thursday so we’ve completed only two days. At only 40% through, my brain is already jam-packed. I can’t possibly summarize everything we heard but I’ll give you a few nuggets.

- Dave Rosenberg, our traditional lead-off hitter, started the event on a bearish note. Back at the 2009 SIC, if memory serves correctly, he turned from bearish to bullish. Not anymore. He thinks we are in an outright depression and won’t recover for a long time. He thinks those who expect recovery this year are delusional because many of the job losses will be permanent and probably half of small businesses will fail.

One of Dave’s points I found particularly compelling: The staggering amounts of money governments have already spent aren’t “stimulus” as we normally use the word. They are more like “life support.” They’re helping contain the damage, but they aren’t going to bring the economy back. That part hasn’t even started yet.

Dave distinguishes “depression” from a milder recession by the permanent behavioral changes it produces. He thinks consumer spending will change as people focus on needs rather than wants, and the savings rate will rise as they prepare for the unknown. His best case is for recovery by 2023, and a slow grind from here to there. But he also named several sectors he thinks can outperform along the way, so he’s not entirely despondent. He is not running for the hills, he’s just running to different hills.

- Later Monday, Dr. Lacy Hunt amplified some of Dave’s points. He thinks we may initially see an impressive-looking recovery just because the economy will improve from such low levels. He doesn’t expect it to last long, or reverse the lost output and employment. The debt overhang he’s been describing is now even worse and will affect growth for years to come.

Like Dave, Lacy expects private savings to rise but he thinks government debt, which is actually “dis-saving,” will overwhelm private savings and leave the nation’s savings rate net negative. That hasn’t happened since the 1930s. Between falling debt productivity and unfavorable demographics (low population growth) he sees a dismal growth picture. But he also points out other economies are in even worse shape, so the US should still be the relative leader.

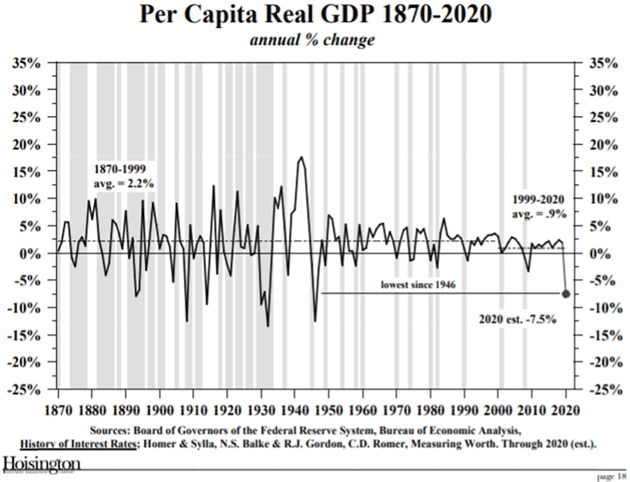

As is his usual style, Lacy illustrated his speech with powerful charts. Let me show two that I found particularly interesting. The first was a projection of the output gap: how much the economy is producing versus what it could produce. It is dropping us to the lowest level since World War II.

In the real world, that means much lower employment and productivity.

The next is per capita GDP, which is the lowest since 1946 and the Great Depression. That is just an estimate through first quarter and a little bit of this quarter. If Rosie (and Jim Bianco who we will talk about in a moment) are correct, per capita GDP could drop to the lowest levels ever.

And Then We Look at Politics

It is, after all, an election year. Normally, I try to stay out of the political arena. Elections have less effect on the economy than you might think. And to be fair, politics is a hobby for me, not a profession. I am certainly no expert. However, given the potential for a significantly different political climate, we would be remiss if we did not pay attention. We had two presentations from political analysts, and then a spirited panel discussion.

- Historian Bruce Bartlett is known as a conservative, but after criticizing the GWB administration and then adopting Keynesianism quite publicly (in a book that was the opposite of everything he had written for the previous 20 years), I find him a fascinating thinker. I may not agree with him, but I do pay attention.

Bruce sees almost no chance Trump will be reelected. He argues that presidents who face this kind of economy in the last year of their term almost never fare well, and Trump has the virus issue on top of it.

He also had an interesting economic insight. Like Dave Rosenberg, he thinks we will see important behavioral change but he thinks in the opposite direction. People will take a more “live for today” attitude, similar to the Roaring ‘20s. This might be bullish for consumer spending.

- Lobbyist Bruce Mehlman views this period as less of a radical change, and more an acceleration of change that was already underway. You know some of them: globalization, multilateralism, US-China tension, technology. Bruce thinks the political divide will widen, pressures will rise against “Big Tech,” and populist pressures will grow. He expects more resistance to immigration, suspicion of China, and greater emphasis on security and austerity. He thinks it is too early to make a reasonable prediction, but today he would give a potential edge to Trump, noting that could change easily.

- Ben Hunt of Epsilon Theory participated on the political panel, but where he really caught fire was in the closing presentation, where he outlined three narratives on COVID-19, and then proceeded to systematically tear them apart because they are first and foremost political strategies, and not necessarily scientific.

I was struck as I listened to him about how criticism of the politicization of COVID-19 coincides with my own views on economists and politicians. I have said often that some economists are like witch doctors or shamans of the past. They would sacrifice sheep, look at the entrails, and predict the future. Politicians use economists to make models showing the correctness of whatever they want to do anyway. Too many economists are basically pets for politicians.

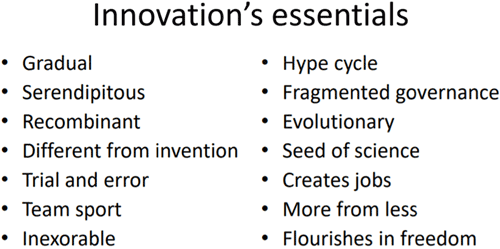

- It is hard to say what my favorite presentation was that first day, but Viscount Matt Ridley, whose latest book How Innovation Works comes out next week, was certainly a highlight. He is perhaps the finest philosophical libertarian thinker of our time. I asked him to focus on the importance of innovation.

First of all, it will be innovation that gets us a vaccine against this virus. And it will be the innovators, millions of entrepreneurs, who create a new economy afterward. While we are still only speculating about how severe the economic downturn will be, we know that business as usual in January 2020 won’t work anymore. Investors need to recognize where innovation is really happening.

As Matt pointed out, Joseph Schumpeter said, “The capitalist achievement does not typically consist in providing more silk stockings for queens but in bringing them within reach of factory girls.”

I will leave you with two selections from Matt’s 47-slide presentation. The first is a list of innovation’s essential elements.

The second is a good reminder for those who extrapolate the current crisis far into the future. T. B. Macaulay, writing in 1830 in reply to the pessimists of his day:

“We cannot absolutely prove that those are in error who tell us that society has reached a turning point—that we have seen our best days. But so said all who came before us, and with just as much apparent reason… On what principle is it that, when we see nothing but improvement behind us, we are to expect nothing but deterioration before us?’’

Real world GDP, after inflation, is up over 15X since he wrote that. The cost of a candle in 1800 that would let you read, however dimly, for one hour, was six hours of labor. Today that same amount of light costs about 3/10 of a second of human labor.

The current crisis won’t slow down the Age of Transformation. As many of the speakers have already pointed out, and others will over the next week, the crisis usually has the potential, if not the probable likelihood, to actually accelerate transformation.

As my dad used to say, “Necessity is the mother of invention.” Or innovation.

Just for the record, and simply for space purposes, I haven’t mentioned all of the speakers—just a few. They were all excellent.

Then It Was Wednesday

We continued on Wednesday, starting with Gavekal’s three founders: Charles Gave, Louis Gave, and Anatole Kaletsky. Louis moderated the other two, who told us where they think the world economy is going in their own inimitable ways. (Getting these three together physically is very difficult. It was a privilege to assemble them virtually.)

- Anatole started on dangerous ground, saying, “This time really is different.” We face not one, but two concurrent unprecedented events: a virus-induced economic collapse and a stimulus tidal wave.

Another interesting insight from Anatole: Markets bounced in recent weeks because better-than-expected public health news raised sentiment from the lows. But he thinks investors are focused so much on that, they are missing the worse-than-expected economic news. When they notice, he expects another leg down and likely a retest of the lows. (Note: Anatole is normally the bull of this trio.)

- Charles looked at the world through the prism of three primary currencies: the dollar, the euro, and the renminbi. All wealth is denominated in a currency so it matters a great deal which one you are in, and what its prospects are.

In his view, the dollar and euro both have serious problems. The euro is a currency without a country and so can’t be used to hedge risk. This makes it unwise to hold euro cash or bonds. The dollar, while stable for now, is vulnerable if oil starts trading in other currencies.

Meanwhile, with the US and Europe cutting back on imports from Asia, Charles sees Beijing trying to generate internal demand and make the region dependent on its currency. He thinks that, and not global reserve status, is China’s main goal. It will lead to a massive revaluation of Asian currencies. So he thinks they are better homes than either the dollar or euro.

- Jim Bianco made a fascinating presentation he called “The 90% Recovery.” He emphasized we have to think in relative terms. Even if most business reopen and some semblance of normalcy returns, it’s still going to be significantly less than before. Even 90% recovery, which he thinks optimistic, will be a disaster relative to the recent past and even compared to the last recession.

Meanwhile, Jim said the Fed is effectively dictating bond yields and well on its way to full-scale “yield curve control” similar to Japan. That would mean we don’t really have a bond market anymore. With prices fixed, there’s no need to trade.

I liked that Jim ended with a hopeful suggestion. If everyone would simply wear masks and practice reasonable social distancing, consumers might regain enough confidence to spend. But that doesn’t seem to be happening and will get no easier as the weather warms up. So we may be stuck well below 90% for a long time.

- Dr. Woody Brock made his usual authoritative presentation, noting that the major difference between the current crisis and any previous recession is the service sector job destruction.

In the 1920s, roughly 26% of the US population worked in the service sector. Manufacturing and agriculture were far more powerful. Factory shutdowns, while not good, no longer cause the kind of mass unemployment they once did.

Today, 86% of the country works in some form of the service sector. That has insulated us from the old-style inventory/manufacturing cycle recessions. We have recessions but they have been less severe, until now. We have lost 30 million and counting service sector jobs. There will be new jobs that will eventually take their place, but it will take years. This is a different type of crisis than we have ever faced.

War of the Experts

I came across this early Friday morning before the conference started. It fits part and parcel with the themes that I have been hearing at the conference. Fareed Zakaria writes about Michael Lind’s book, The New Class War.

Explaining why so many people across the West have rejected the government establishment, Michael Lind writes, “The issue is not the issue. . . The issue is power. Social power exists in three realms — government, the economy, and the culture. Each of these three realms of social power is the site of class conflict.” In all three, leaders tend to be urban, college-educated professionals, often with a postgraduate degree. That makes them quite distinct from much of the rest of the country. Only 36 percent of Americans have a bachelor’s degree, and only 13 percent have a master’s or more. And yet, the top echelons everywhere are filled with this “credentialed overclass.”

How does that relate to our current crisis? Fareed writes:

Imagine you are an American who works with his hands—a truck driver, a construction worker, an oil rig mechanic—and you have just lost your job because of the lockdowns, as have more than 36 million people. You turn on the television and hear medical experts, academics, technocrats, and journalists explain that we must keep the economy closed—in other words, keep you unemployed—because public health is important. All these people making the case have jobs, have maintained their standards of living and in fact are now in greater demand. They feel as though they are doing important work. You, on the other hand, have lost your job. You feel a sense of worthlessness, and you’re terrified about your family’s day-to-day survival. Is it so hard to understand why people like this might be skeptical of the experts?

George Friedman (whose SIC presentation was also a home run) talks about two geopolitical cycles: a 50-year cycle and an 80-year cycle, which for the first time will coincide in the late 2020s. These are historically times of great upheaval and change. One of those cycles always is about distrust of the elites and frustration. Together, it promises to be a complete reordering of society. And when we look back, we are going to have the prism of COVID-19 to understand part of the problem.

COVID-19 is not just pulling technology forward faster. It may also be pulling forward the societal transformation George expects. There is a lot to think about and there is certainly fodder for future letters.

As I said above, we still have two more days of presentations, and it’s not too late to jump in. You can do it now and still get almost the same experience, since your pass includes video of all the sessions. Register here. And of course, you can see the past presentations and transcripts and slide decks at the same SIC website.

I have already made my pitch in prior letters, so I’m going to leave it at that. You really do want to be there, watching the sessions at your leisure or reading the transcripts.

Puerto Rico and the World

It is not often that I can say this is my first rodeo. I have been on TV many times, often sitting alone in a studio looking at a camera. But doing a virtual conference was more than a little different. While we had a few hiccups, they were minor and some were funny. Let’s just say when you’re presenting from your home, stuff happens in the background.

And if someone who is on screen loses their connection, you can have dead space. That’s the worst thing in the world. As I was interviewing Woody Brock on Wednesday, he suddenly disappeared from my screen. To me, it looked like he was gone and we had dead space.

I floated in indecision for about 10 seconds, waiting for Ed or someone to jump in. I could see the questions people were asking Woody, so I just started answering them. Then I made some comments about what we had seen before. Then I started making up new questions to answer so we wouldn’t have that dreaded dead space. I was looking straight into the camera and I was passionate. Frankly, those were some of my best moments.

After about 10 minutes, with nothing coming in on my phone and still nobody showing on my screen, I reached over to my iPad and noticed the next panel had already started. I was simply talking to myself. It turned out that we have a limited number of dedicated lines and when it was time to switch over to the panel they simply took my line and kept Woody, since he was part of that panel. No one bothered to tell me.

Now I have solemn promises that someone will tell me if that ever happens again. It actually has me laughing and in a good mood to start the third day of SIC. We have a China panel, Neil Howe, Ian Bremmer, and so much more. It will be a good, good day. Have a great week and stay safe out there.

Your trying to drink it all in analyst,

John Mauldin

The BullsNBears.com website was founded by market crash expert Michael Markowski to specialize at publishing articles by him and by other authors who have been screened. The articles pertain to market crashes, market bottoms and recessions and depressions. Register below to be alerted when a new article is published on BullsNBears.com.